Smart Forex Expert MAM Account 📈💰📊

🚀 SFE MAM Account is now Live on Fusion Markets! 😄

- Let our Smart Forex Expert (SFE) strategy do the heavy lifting while you sit back and grow your capital — 100% hands-free.

📈 Why Join?

- Monthly Return: 5-10% (target)

- Max Drawdown: 30% (tested)

- Backtested & Verified

- Performance Fee: 20%

- ✅ No minimum deposit required — but please note:

- 💰 If you account balance is Below $2,000: You may miss some BTCUSD (Bitcoin) trades

- This due to the minimum trade size requirement (0.01 lot), which smaller accounts may not meet

🎯 How to Join in 4 Quick Steps:

1. Open a trading account at Fusion Markets

2. Contact Fusion Markets Live Support

- Request a new MT4 account on Server 2 (FusionMarkets-Live 2)

- Set: USD base currency, Zero account type, 1:500 leverage

3. Fund your account and download the LPOA form

4. Complete & return the LPOA Form

- Fill in your name + MT4 account number (Witness signature required for individual accounts)

- Send the completed form back via Telegram or email: SFETrading@hotmail.com

- ✅ Once received, we’ll get your sub-account linked to our MAM account — and you’ll be live and trading in no time!

Let our proven algorithm work for you — 24/5. Minimal effort, professional results.

📩 Got questions? Message us anytime. We’re here to help!

📈 How to Invest with SFE MAM

The SFE MAM should be viewed as a long-term investment strategy. It is not designed for short-term speculation, but rather to deliver consistent returns over time through statistically proven trading methods.

While short-term fluctuations are inevitable in any trading system, it’s important not to focus too heavily on individual wins or losses. The SFE MAM is built on a robust statistical edge that has been proven to perform over a large number of trades. With patience and consistency, this edge is expected to generate strong long-term results.

Think of it like how professional poker players and card counters in blackjack approach their craft: the goal is not to win every hand, but to execute a strategy with positive long-term expectation—and to scale up intelligently when the odds are favourable.

For those unfamiliar with Smart Forex Expert (SFE) systems, the SFE MAM is managed by the same developer behind some of the most successful automated strategies on the MQL5 platform:

SFE Portfolio 1 – View Signal: Over 1,600% return since 2015

SFE Impulse – View Signal: over 300% return since 2023

The SFE MAM incorporates some of the most advanced Expert Advisors (EAs) developed to date, and we have strong confidence in their ability to deliver over time.

To benefit fully from the strategy, we recommend allocating funds that you do not intend to withdraw for at least 6–12 months. This gives the system’s statistical edge time to play out and gives your capital the best opportunity to grow. That said, you always retain full flexibility and can withdraw your funds at any time.

Thank you to those already on board. We look forward to what’s ahead—and to capturing many more green pips together with the SFE MAM. 😄

❓ SFE MAM - Frequently Asked Questions

1. How do SFE systems work?

SFE systems use a momentum-based trading strategy, entering trades after strong market moves with the goal of riding continued price momentum. When market conditions become even more favorable—such as when volatility or price action confirms the trend—the system may open additional positions. It’s similar to how a skilled poker player increases their bet with a strong hand, or how a card counter in blackjack bets more when the odds are in their favor. The system adjusts its risk based on statistical advantages, aiming to maximize potential while managing downside.

2. What instruments are traded?

Our SFE systems now trade exclusively Bitcoin (BTCUSD) and Ethereum (ETHUSD), as these markets consistently offer the strongest momentum and price action, making them ideally suited to our trading strategies.

3. Is Fusion Markets reliable?

Yes. Fusion Markets is regulated by ASIC (Australia) and has a physical office in Melbourne. They are known for low spreads, reliable trade execution and smooth deposit / withdrawal processes.

4. How much risk is taken per trade?

Trades on the MAM account risk between 0.33% and 0.67% of account balance per trade.

5. What is the expected monthly return and max drawdown?

Backtest Results from 2021-2025: Here

- Estimates allowing for live trading conditions:

- Monthly gain: 5-10%

- Max drawdown: 30%

6. Can I withdraw funds anytime?

Yes, withdrawals can be made at any time. However, please note that active open trades may affect your available balance

7. What are the fees?

20% Performance Fee apply only to net new profits, based on a high-water mark model

8. What is the minimum deposit?

There is no minimum deposit requirement, however we recommend a minimum deposit of $2,000 USD, for optimal risk and position sizing.

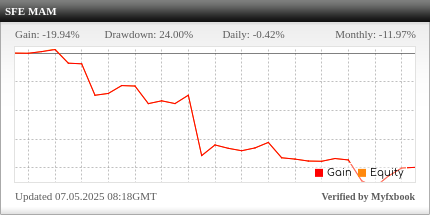

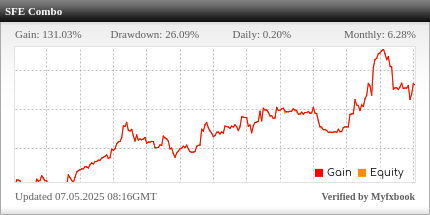

📊 Live Performance

Current Strategies for SFE MAM (updated Dec 2025):

- SFE Raw Impulse - 0.67% Risk Per Trade

- SFE Swing EA - 0.33% Risk Per Trade

Current Strategies for SFE Combo (Updated Dec 2025):

- SFE Raw Impulse - 1% Risk Per Trade

- SFE Swing EA - 0.5% Risk Per Trade Trade

Current Strategies for SFE 10K to 1MM (Updated Dec 2025):

- SFE Raw Impulse - 1% Risk Per Trade

Please Note: SFE Combo and SFE 10K to 1MM are currently available for trade copying via Fusion+ Copy Trading, BUT ONLY UNTIL DEC 31st 2025

👉 Use the links below to sign up (log into your Fusion Markets client portal first):

🔹 SFE Combo → https://hub.fusionmarkets.com/follower-join/a3I68P0Vl6 (Tip: you can set 1.5x risk for the High Risk version)

🔹 SFE 10K to 1MM (now running SFE Raw Impulse 1% Risk Per Trade since Aug 2025) → https://hub.fusionmarkets.com/follower-join/aqi62N3Nua

There is no upfront cost to sign up to the signals, except a monthly account fee of $10 charged by Fusion Markets. Clients pay 20% Performance Fee only after a profitable month (based on High-Water Mark)

ℹ️ Other Info

- SFE Telegram Group (to chat with other members): Smart Forex Expert Community

- SFE Telegram Channel (for announcements): Smart Forex Expert Channel

- Please contact me directly on Telegram @JimmySFE if you have any questions 😊

📜 Disclaimer

Risk Warning: Trading forex and CFDs involves substantial risk and may not be suitable for all investors. The services offered on copy.smartforexexpert.com, including copy trading and Multi-Account Manager (MAM) services, involve leveraged financial products. These products can result in losses that exceed your initial investment.

No Guarantee of Returns: Past performance is not indicative of future results. All trading strategies carry inherent risk, and there is no guarantee of profit.

Personal Responsibility: Any decision to participate in a MAM or copy trading service is made at your own discretion and risk. You are solely responsible for assessing the suitability of these services for your financial situation and objectives.

Not Financial Advice: The content on this website is provided for general informational purposes only and does not constitute personal financial, investment, or trading advice. While we offer managed trading services, we do not provide tailored recommendations or solicit specific investments.

Third-Party Services: Our services may depend on external brokers, trading platforms, or technology providers. We are not responsible for any losses, delays, or disruptions caused by third-party services.

Market and Leverage Risks: The forex and CFD markets are highly volatile. Leverage can amplify both potential gains and losses. You should only trade with capital you can afford to lose.

Regulatory Responsibility: It is your obligation to ensure that participation in MAM or copy trading services is legal in your country or jurisdiction. We do not offer our services in regions where such offerings are restricted or prohibited by law.